What happens to startups that stall?

Options exist for slower-growing startups that hit a VC fundraising wall

Psst… check out some upcoming Lynx Collective programming:

Inside: Betaworks with Partner Jordan Crook (July 1) - for active founders only

NYC VC Summer Rooftop Party (July 18) - for investors only

And a quick message from our sponsor:

Get simple, powerful business banking for startups with Rho - and get $500 when you use the promo code LYNXCOLLECTIVE. *Terms and conditions apply.

While venture-backed startups aspire to transform the world and achieve immense success, only a tiny fraction reach unicorn status. Many of the rest, despite having steady revenue growth and a clear path to profitability, struggle to secure additional venture funding. That’s because VC firms prioritize high-growth, massively scalable businesses that promise substantial returns—it's the nature of their business model.

According to the latest Carta data, only 10% of startups that raised a Series A in the first half of 2022 have raised a Series B within 2 years. This is a way lower percentage than what we have seen in the last 5 years. The funding traffic jam is real. So, what becomes of the startups that no longer align with VC investment criteria?

Enter MBM Capital. MBM Capital focuses on "thoroughbreds, not unicorns"—venture businesses that might not currently be on a unicorn trajectory, but demonstrate clear product-market fit, generate revenues between $3-25M, and have a defined path to profitability. MBM is enthusiastic about solid businesses that often get overlooked by typical Series A/B investors. The firm steps in to invest, provide assistance to overcome obstacles, and uncover additional value.

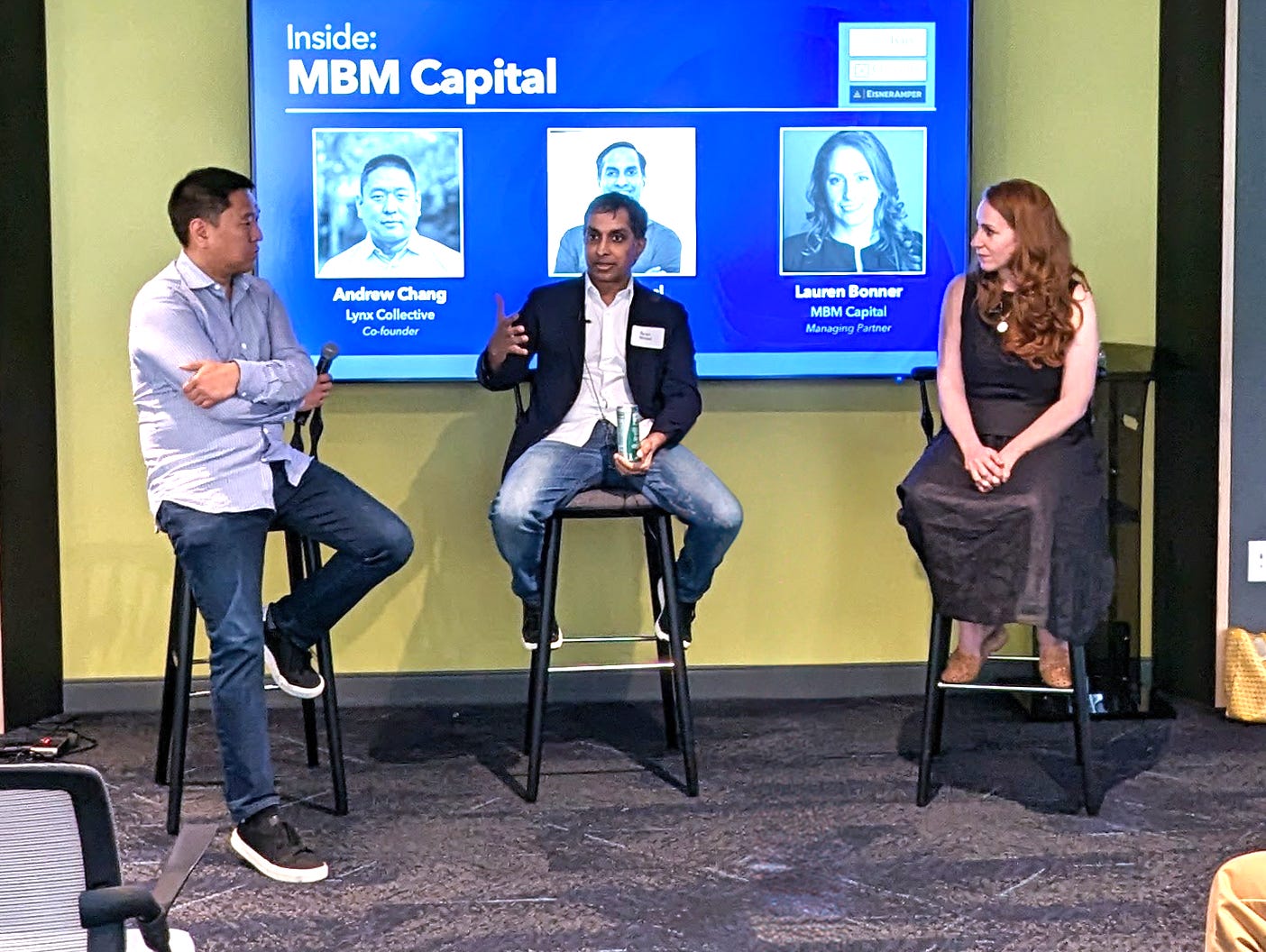

A few weeks ago, I had the opportunity to interview Arun Mittal and Lauren Bonner to gain deeper insights into their investment model. Here are the key takeaways from our conversation, and you can watch the full video at the end of this post.

Key insights and takeaways

Sometimes, becoming a unicorn simply isn't in the cards

There are countless reasons why a promising startup may fall out of the traditional venture model which targets billion-dollar exits. These could include market shifts, unfortunate timing, poor management, or simply the fact that it was never meant to be. The "unicorn or bust" mentality is a rigid, binary framework that startups can escape by focusing on profitability.

Seeking a $25m-$200m exit is a whole lot easier than a $1b+ outcome

Although exits remain challenging even at the $25M-$200M level, there are significantly more strategic buyers at these lower price points. Startups that have moved from 0 to 1 and have some revenue traction might only require a few adjustments in their team, go-to-market strategy, or other areas to align with these more realistic exit opportunities. Much of this misalignment stems from the "billion-dollar exit or bust" mentality.

Making the shift out of “unicorn mode” can be emotional

Many of the initial conversations MBM has with founders can feel therapeutic. Shifting a founder's mentality from chasing unicorn status to focusing on building a solid, profitable business involves a significant emotional adjustment. Founders who have operated with a big vision and hockey-stick growth mindset for years must now redirect their focus to fundamentals and profitability. It's no longer about changing the world, but about building a robust business. After the initial emotional reaction, working towards building a solid business and achieving an exit can help founders feel a true sense of accomplishment for all the hard work they’ve invested in their companies.

Companies are not being decisive enough to downsize faster

Founders are often slow to reimagine their businesses when necessary. Sometimes, investors pressure founders to maintain the status quo while waiting for a strategic investor, and other times, founders cling to hope. This creates immense pressure on the business and shortens the runway. If you have 12 months or less of runway left, consider conserving cash and making those tough decisions sooner. Almost no one ever regrets downsizing more quickly.